Stories

Whisky is a passion to explore. From the history of the spirit to the evolution of the industry, the story of whisky helps fuel that passion. Often, it’s easy to forget that whisky is also a global multibillion dollar industry. The stories of whisky — from news and new releases to in-depth inquires and what goes on behind the label — blend together to help us appreciate the spirit of whisky.

Kentucky Bourbon Distillers Set New Records in 2019

By Mark Gillespie

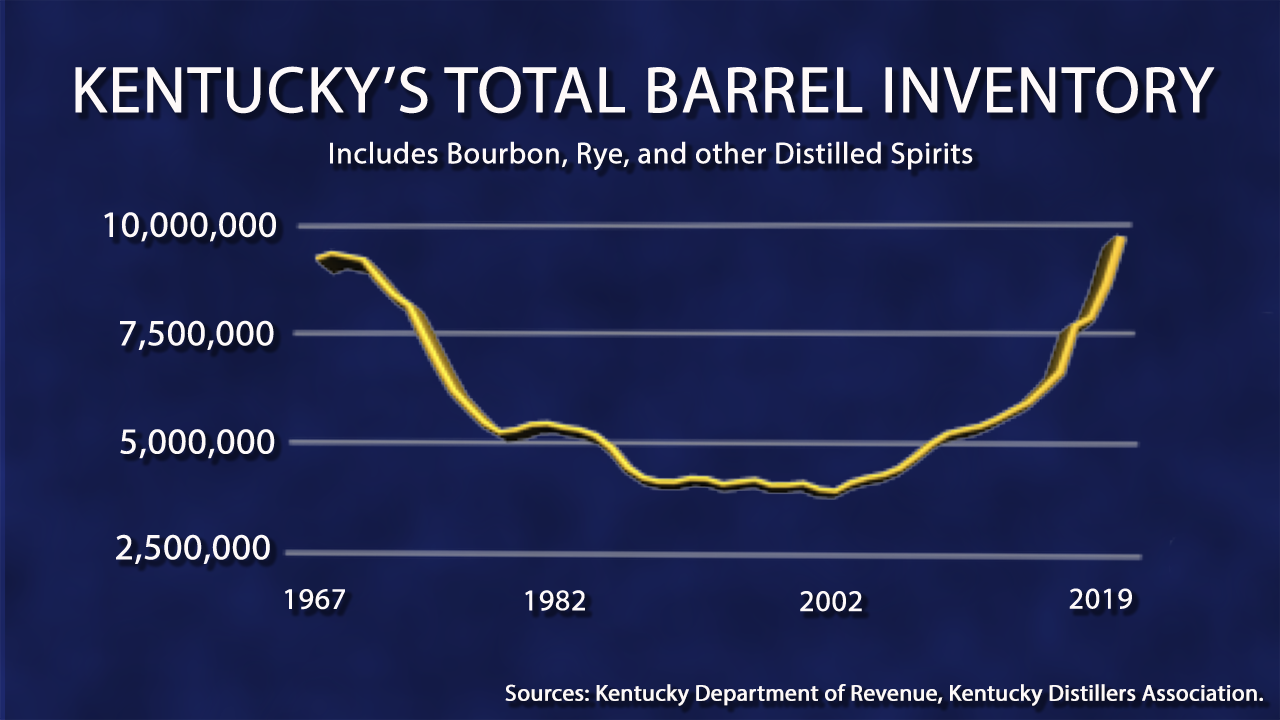

October 31, 2020 – Imagine having to count nearly ten million barrels of whiskey and other spirits by hand. You’d run out of fingers – and toes – pretty quickly.

Of course, we’re kidding about counting every barrel one-by-one with fingers. The Commonwealth’s distillers have spreadsheets to keep track of their inventory of maturing barrels, but it still takes months for the state’s Department of Revenue to compile that data from every licensed distiller, blender and bottler in Kentucky. Industry members are required to disclose the exact number of barrels held in bonded storage as of January 1 each year so that local governments can assess the “barrel taxes” that are used to fund schools and other public services. Kentucky is the only state that imposes taxes each year on inventories of maturing spirits.

With more distilleries and whisky makers opening up every year, it takes the state longer to release the final report every year. In previous years, the report was usually available by late summer, but has been delayed more and more in the last several years. The 2019 report released this week shows that for the second consecutive year, distillers filled more than 2 million barrels of Bourbon.

The exact number: 2,122,954.

In addition, the total number of maturing barrels held in inventory statewide also set a new record for the second consecutive year. As of January 1, 2020, Kentucky’s rickhouses held a total of 9,864,197 barrels of distilled spirits, up from 9.1 million a year ago. Of that, 9,226,228 held Bourbon, with the rest dominated largely by Rye Whiskey and Brandy. It’s the first time since record-keeping began in 1967 that the total number of maturing Bourbon barrels exceeded nine million.

“Over the past five years, we just continue to grow by leaps and bounds and break records almost every year, but the great news for the Commonwealth is that this means more jobs and investment,” Kentucky Distillers Association president Eric Gregory told WhiskyCast in a telephone interview. “You know, every barrel eventually becomes bottles. You’ve got to have employees to to make it, to barrel it, to bottle it, and to store it. More warehouses equals more tax revenue, which is used predominantly to fund education in Kentucky. And it just shows that the industry continues to grow and the future is bright,” he said.

The report includes data from all of the state’s licensees, not just KDA members.

Licensees are paying nearly $30 million in “barrel taxes” to local governments this year, and those taxes are the largest in-state tax bills of the year for most of Kentucky’s whiskey makers. In 2014, state legislators changed the law to allow distilleries to take a credit for their barrel tax payments against their state income taxes in a move that protected revenue for local governments while recognizing the value of the industry to the state’s economy. However, recent reductions in Kentucky’s corporate income tax rate now mean many larger distilleries wind up with leftover barrel tax credits each year after reducing their state income tax bill to zero.

Gregory and his members have been pushing legislators for the last couple of years to revisit the barrel tax system. While eliminating barrel taxes would require coming up with a new funding method that preserves revenue needed at the county level, the KDA supports a plan that would either make excess tax credits refundable or transferrable to other companies. For instance, a distillery with $1 million in excess barrel tax credits could transfer those credits to a construction company as partial compensation for work on the distillery’s construction projects, with the contractor then being allowed to apply those credits against its own state income tax bill.

That could help fuel additional capital improvement projects, even though the industry’s ongoing $2.3 billion capital investment campaign means virtually every distillery already either has construction work underway or on the drawing board at the present time. For instance, Heaven Hill has been building two new warehouses each year at its Cox’s Creek Maturation Campus near Bardstown, while non-KDA member Buffalo Trace has completed three new warehouses in the past year as part of its own $1.2 billion long-term investment program in Frankfort. In addition, Beam Suntory is investing $60 million to build the new Fred B. Noe Craft Distillery at its Jim Beam Distillery campus in Clermont and upgrade the visitor experiences on-site.

This year’s report does not take into account any potential impact from the Covid-19 pandemic. While all of the state’s distilleries were forced to close their visitors centers for several months under public health restrictions, Gregory predicted little impact from the pandemic on 2020’s production statistics.

“Thanks to our wonderful governor, Andy Beshear, who’s done a great job of handling this pandemic, the Bourbon industry, distilling was declared an essential business in Kentucky, so we haven’t missed a beat. Obviously, our tourism centers were impacted and shut down for a brief time…the great majority of them, almost all of them are reopened now. But I don’t anticipate any any real loss in that barrel production or the inventory at all,” he said.

Links: Kentucky Department of Revenue | Kentucky Distillers Association